Do you know what a smart business decision looks like? Importing goods in bulk from China for resale in South Africa. Do you know what a business headache looks like? Importing goods in bulk from China for resale in South Africa. We’re not trying to trick you: it can be both! The world of international shipping logistics is difficult to navigate. Shipping costs, delivery timelines, importers codes, and HS codes…it’s like learning a new language.

We’re here to help. You can learn more about how to ship without an importers code here, and we’re about to explain what HS codes are right now!

So…what is an HS Code?

The “HS” in “HS code” stands for Harmonised System. Every item you can imagine shipping (ever) has a corresponding HS code in the same way that every South African citizen has an ID number.

The Harmonised System is a product classification guide that is used everywhere in the world. HS codes are administered by the World Customs Organisation (WCO). They’re updated every five years. The seventh and most recent edition of HS codes was published in January 2022. But don’t panic – we’ll get you up to speed! Using a trusted logistics partner can help you stay on top of the updated HS codes and avoid customs penalties.

What are HS codes used for?

The six-digit HS code is used to classify the product that you are shipping. This classification is used to accurately calculate your taxes, duties, and any restrictions that might apply.

The relevant authorities also use HS codes to keep track of import and export rates. It’s not that different from the international travel of human beings! Much like you can’t travel without your ID number, your goods cannot travel without their HS codes.

Just like travelling internationally with your passport is a non-negotiable legal requirement, it is a legal requirement that your goods are shipped with the correct HS codes.

What happens if I don’t have one?

If your goods are shipped without their HS codes or with the incorrect codes, this could mean bad news for your delivery timelines and your penalties. For one, the receiver might pay the wrong kind of tax on the shipped goods. Secondly, you could experience shipping delays, which have a nasty knock-on effect on your business operations and customer satisfaction.

Most importantly, using the incorrect codes can be interpreted by customs as non-compliance, misleading, or misdeclaration. All three can incur fines.

How do I get an HS Code?

Airpool has countless free resources for our clients – one of these is a handy web directory of HS codes for South African shippers, which can be found here.

How to decode your HS Code

If you’ve had a chance to look at the HS code directory, you might be feeling a bit overwhelmed. Everything has a very specific HS code that sorts it under a different product category in the

guide! We’ll break it down into less scary bits for you:

First 2 numbers = chapter

Second 2 numbers = heading

Final 2 numbers = sub-heading

Sometimes there are extra numbers in the HS code which can supply additional information. Every HS code will have at least six digits, and they all mean the same thing – the chapter, heading, and sub-heading of the product classification guide.

HS codes aren’t so scary after all, are they? Especially when you’ve got a well-informed logistics partner who has your back. Browse the rest of our free resources (and don’t be shy to contact the team with the chatbot!) on the Airpool site!

Can Entrepreneurs Really Afford To Import? [UPDATED]

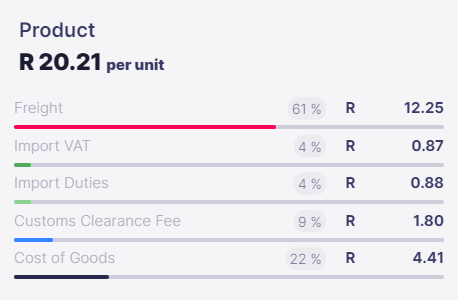

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)