What if we told you that we have a way to ship goods without an importers code? We explain what an importers code is and how to ship without one so that you can get back to doing what you do best: being a boss!

Let’s set the scene: you’ve had a brilliant business idea, drawn up the plans, found a supplier in China and you’re ready to start selling to your customers. But, when you get to Googling how to transport your goods from China to South Africa, you encounter something called the “importers code”. This could mean a major pothole in the road to building a successful business.

What is an importers code?

An importers code is a code issued by SARS to authorise businesses like yours to override the import restrictions put in place by South African tax law. Technically, anyone can ship goods to South Africa without an importers code, but they can only do so under the following restrictions:

You may only import goods three times per calendar year.

Your goods cannot be valued at more than R50 000.

You may only import goods for personal use.

That’s just not going to work for a business owner like you. You need to be free to import as many times as you need, to an unlimited value, and for reasons beyond personal use. So – what does the process of getting an importers code entail?

How to get an importers code

The process of getting an importers code is, in a word, a headache. First, you need to apply for an importers code from SARS by filling out the DA 185 and DA 185.4A1 forms, which are buried amongst thousands of similar-looking forms on the SARS website.

These forms require a long list of supporting documents, including proof of address, a certified copy of your ID, certified copies of your VAT, IT, UIF, SDL, and PAYE letters, a bank statement…we really could go on and on.

Not only are you required to navigate tricky forms and collect an encyclopedia’s worth of personal information, you then have to submit your application to the nearest Customs office.

The complexity of this process is enough to leave anyone storming out of a SARS queue out of sheer frustration and despair. Thankfully, there’s a way to eliminate the nightmare of importers codes!

How to ship without an importers code

Airpool is like a logistics multi-tool. Normally, a small business owner like you would have to place separate orders with separate suppliers in China, leaving you paralysed by import fees and mummified by red tape. Airpool allows you to source your goods from multiple suppliers in China and consolidate them into one package shipped to your door from our hub in the city of Yiwu, saving you precious time, money, and energy. Once you’ve shipped your goods to our hub, you won’t have to worry about your consolidated package again until it rocks up on your doorstep – freeing you up to tend to your growing business.

Unlike most logistics companies, Airpool doesn’t require you to get an importers code before you ship with us. That’s because Airpool acts as your importer and exporter of record. This means that we’re the ones taking care of completing and filing the relevant documents, facilitating the payment of import fees, and making sure that everything is customs-compliant. We like to call ourselves the Google Translate of logistics – we’ll make everything make sense for you!

If you’re looking to ship goods from China without an importers code, then you’ve come to the right place. Your entrepreneurial skills shouldn’t have to include decoding local import and export requirements. Leave that to us! We’ll focus on procuring the goods; you focus on selling them. Airpool’s cost-effective solutions will get your precious cargo from our hub in China to your doorstep without you having to get up from your office chair.

Get in touch with us at https://airpool.co.za/ to begin the shipping partnership of your dreams!

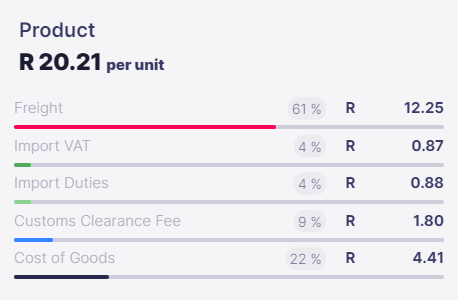

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)