If you’re planning on importing goods to South Africa for your small business, you may be faced with a few complex customs requirements. From navigating import duties to tackling taxes and fees, including VAT, there’s a lot to consider. One of the biggest concerns for many business owners who opt for an Importer of Record (IOR) is the ability to claim back import VAT.

But here’s the good news: Even if you choose to use an IOR for your imports, you can still claim back the import VAT. In fact, being a registered IOR is not a prerequisite for reclaiming import VAT, as long as you are VAT registered and meet certain requirements outlined in Section 54(2A)(a) of the Value-Added Tax Act 89 of 1991 (the VAT Act).

An Importer of Record (IOR) refers to the individual or organisation situated in the receiving country who holds the responsibility of ensuring the fulfilment of compliance obligations during the process of importing goods across international borders.

Choosing to appoint an IOR comes with numerous benefits, particularly when it comes to avoiding any confusion among suppliers, distributors, and end users regarding the ownership of the goods. By designating an IOR, you can clearly draw the lines, ensuring a smooth import process.

To better grasp how the VAT reclamation process works, let’s take a closer look at the relevant section of the Value-Added Tax Act 89 of 1991 (the VAT Act). Section 54(2A)(a) of the VAT Act allows an agent to import goods on behalf of another person, who is referred to as the principal.

In this case, the agent holds the import documentation, but the import is deemed to have been made by the principal. This means that the principal retains the right to claim import VAT if they are a VAT vendor and are engaged in making taxable supplies.

It is important to note, though – that in order to claim import VAT, the principal must be in possession of a statement issued under Section 54(3)(b)(ii) of the VAT Act. This statement serves as evidence that the import has been made by the principal, even if the import documentation is held by the agent. By ensuring compliance with Section 16(2)(dA) of the VAT Act, South African businesses can reclaim the import VAT they are entitled to.

So, just to reiterate – as long as you are a VAT registered business and fulfil the requirements outlined in the VAT Act, you can reclaim import VAT, regardless of whether you are a registered IOR or if you choose to use the services of an IOR. This flexibility is particularly beneficial if you don’t have the resources or infrastructure to handle the complexities of importing goods on your own.

At Airpool, we go beyond just providing hassle-free and cost-effective consolidation shipping services. We understand that importing goods can be a complex process, which is why we also offer comprehensive IOR services to meet your specific needs.

Our team of experts is well-versed in the intricacies of customs regulations and procedures and can assist you in meeting all the requirements for claiming back import VAT. Rest assured that we will handle all the necessary documentation, ensuring that your imports are handled smoothly and efficiently.

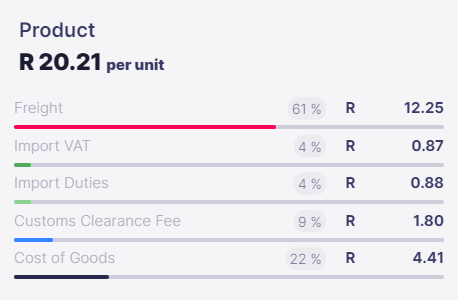

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)