When it comes to finding a wide range of products, China is often the go-to destination for many businesses. Whether you’re seeking affordable goods or high-quality products, Chinese manufacturers have everything under the sun.

But here’s the thing: when you decide to import goods from China to South Africa, you’ll have to brace yourself for loads of paperwork, tricky customs procedures, and plenty of legal hoops to jump through. That’s why it’s incredibly beneficial to have a reliable shipping partner by your side. They can simplify the entire import process and help you navigate through the challenges that customs clearance may throw your way.

As you already know, importing goods involves a significant amount of paperwork and requires specialised knowledge. In addition to handling the logistics of transporting goods, importers must navigate technical customs and legal procedures. Managing import VAT, filing accurate customs paperwork, and assigning the correct HS codes are just a few examples of the complexities involved.

Why is it so important to get all this right? Well, if you ship merchandise with incorrect paperwork, you’re risking penalties, additional charges, and costly delays. This is where a reliable shipping partner becomes invaluable as they can take care of the entire process, ensuring timely delivery and minimising the risk of additional charges.

When you import goods from China to South Africa, there are certain procedures you need to follow at both ends. Before your products are shipped, they have to go through customs in China. A consolidation service can take care of making sure that the right packages with the correct documents reach the customs authorities. Once everything is verified, you will receive an invoice. After you make the payment, the packages are combined together and sent to South Africa.

When your packages eventually arrive in South Africa, they have to go through customs clearance on this side too. You will need various documents like a commercial invoice, packaging list, HS codes (codes that describe your products), certificate of origin, and permits. Customs will carefully examine these documents and check the goods if needed. They’ll calculate the duties and VAT you need to pay, and sometimes they might even request samples or additional information.

Import duties and taxes can vary depending on the type of product you’re bringing in. You’ve got general import duties, ad valorem import duties, excise duties, and other charges that might apply.

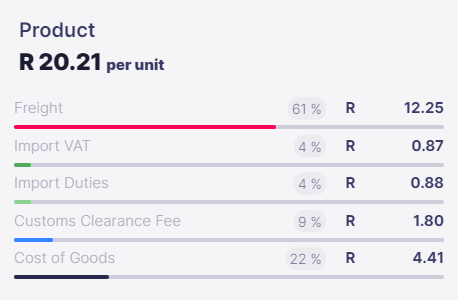

When you choose Airpool as your shipping partner, you can avoid the hassle of going to SARS and dealing with these costs on your own. By registering and logging in on our website, we’ll handle all the number crunching for you! All you need to do is place an order, provide the HS codes, cost of goods, weight, and quantities of your products, and our comprehensive tool will give you a detailed cost analysis – for that specific order.

And not only do we provide you with a total landed cost, but we also break it down to a per-product basis, which is a significant game-changer. We give you all the nitty-gritty details that most people have no clue about when their products hit the country. Airpool is the only shipping service out there that offers such a comprehensive tool. So, why stress yourself out when you can let us handle it all?

When you choose Airpool, you’re choosing a partner that puts customer service above all else. We understand the frustration of delays, the sting of penalties, and the importance of timely deliveries. That’s why we leave no stone unturned when it comes to accurate documentation and seamless customs clearance.

Navigating the unique challenges of your import journey, including customs hurdles, is our “special delivery”. So, why settle for a “plane” shipping experience when you can take flight with Airpool?

Get in touch with us to find out more and let’s start navigating customs together.

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)