Feeling the effects of rising inflation? Our latest article provides insights and tips on how to tackle these high inflation rates and keep your business afloat.

The world of small business ownership can be a rollercoaster ride of ups and downs, but there’s one thing that can throw even the most experienced entrepreneur for a loop: inflation. When the cost of goods and services rises, it can be a real blow to your bottom line.

According to Statistics South Africa, the average inflation rate in SA was 6.9% in 2022, which represents an increase from 4.5% in the previous year. This is the highest inflation rate recorded since 2009. Coupled with interest rate hikes and dreaded load shedding, it’s a recipe for disaster.

The truth is, rising inflation affects businesses in different ways depending on the nature of their goods or services. If you’re a retail mom-and-pop shop, particularly if you’re shipping your products from overseas, you’re probably feeling the pinch more than most. But don’t fret, there are still steps you can take to mitigate the impact and keep your profits from deflating.

Cut costs without cutting corners

When times are tough, it can be tempting to cut costs wherever possible. But be careful not to cut corners in the process. Cutting corners may seem like a quick fix, but it can often lead to long-term problems. Instead, focus on finding ways to cut costs without sacrificing quality or customer service.

For example, you could look for ways to streamline your operations, such as automating certain tasks or outsourcing non-core functions to third-party providers. You can also look for ways to reduce your overhead costs, such as by switching to energy-efficient lighting or by negotiating with your landlord for lower rent.

Inflate your prices (slightly)

We know, we know. This might be the last thing you want to do, but hear us out. It’s okay to raise your prices slightly to keep up with inflation. You don’t want to shock your customers with a massive price increase, but a small bump here and there is perfectly acceptable.

In times of high inflation, it’s important to focus on providing value to your customers, not just competing on price. Remember, consumers are willing to pay more for products and services that provide value, so focus on ways to differentiate your business from your competitors. You can add value through exceptional customer service, unique product offerings, or by focusing on sustainability.

Embrace technology

In today’s digital age, technology is your best friend. From cloud-based accounting software to social media marketing, there are countless tools and resources available to help you streamline your operations and reach more customers.

Investing in technology can also help you save time and money in the long run. For example, automating your inventory management can help you avoid overstocking or understocking your products, while also reducing the need for manual data entry.

Explore new revenue streams

Sometimes, the best way to combat high inflation rates is to diversify your revenue streams. Take a look at what’s selling and what’s not and consider adding new products that better align with your customers’ needs. Or, you can look for new opportunities to generate income, whether that’s through partnerships with other businesses or expanding your online presence. By diversifying your revenue streams, you can reduce your dependence on any one source of income, which can help insulate your business from economic fluctuations.

Consolidate your shipments

If you’re importing your goods from China, you’re well aware of how shipping costs can eat into your profits. Consolidating your shipments by using Airpool’s services is the perfect solution to help reduce your shipping costs. By combining your shipments, you can take advantage of bulk pricing and save money on shipping. Plus, you’ll be doing your part to reduce carbon emissions by reducing the number of flights needed to transport your goods. It’s a win-win!

The bottom line

Inflation may be a thorn in your side, but it doesn’t have to be the downfall of your small business. With the right strategies in place, you can keep your small business afloat and thrive in even the toughest economic conditions. Why not take the first step by leveraging Airpool’s hassle-free and cost-effective consolidation shipping service? Get in touch with our team to discover more.

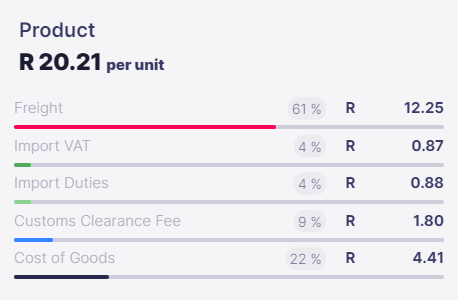

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)