As an entrepreneur, you’re well aware that pricing is one of the most important decisions you need to make. It ultimately influences both your bottom line and how your business is perceived in the market. But to price your products accurately, you need to identify all contributing factors.

The mistake too many ecommerce businesses make is assuming that the cost of goods sold (COGS) and shipping costs are the only expenses they need to consider when pricing their products. In reality, there are a bunch of other expenses associated with the product’s journey from factory floor to the customer’s doorstep.

Without factoring in these costs, it’s hard to know if your business is actually profitable. This brings us to one of the most important terms in global ecommerce: landed costs.

Landed cost is the total amount you spend to transport your goods from your overseas supplier to your store or directly to your customer. It gives you a much more accurate estimate than COGS when setting your list price.

When you calculate the landed costs, you account for every expense that occurs before you get your hands on your products.

These expenses usually include:

When you’re planning on importing products and selling them in the local market, you want to find the most cost-effective way to deliver these products to your customers to ensure you make a decent profit and stay competitive.

Landed cost essentially helps you uncover both the obvious and hidden expenses across your supply chain so that you can make informed import decisions.

It also:

When it comes to calculating the landed cost, it’s not just a matter of adding up all the expenses. Unfortunately, some of these costs can be hard to pin down and calculate.

Freight and courier charges, for instance, might involve multiple transactions in different currencies. It’s also often hard to predict when a shipment will arrive, and fluctuations in exchange rates can lead to significant differences between the expected and actual costs listed on the invoice.

Here’s the basic equation for calculating landed cost:

Product + Shipping + Customs + Risk + Overhead = Landed Cost

Most business owners don’t have the time, resources, or data available to calculate the total landed cost manually, which is why they usually simply skip it and estimate instead. But, as mentioned earlier, this is pretty risky since you won’t know if you’re actually profitable.

If you’re in the business of importing goods from China and selling them locally, you’re in luck. Airpool has a comprehensive tool to help you crunch those landed cost numbers.

To make use of our landed cost function, here’s what you need to do:

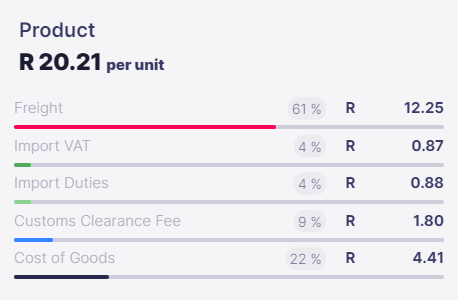

We not only give you the total landed cost, but we also break it down for each product (which is something none of our competitors can say). We give you all the detailed info that most people have no clue about when their products arrive in the country.

No more guesswork. Ship with Airpool, so you can take a load off.

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)