Standing in line at Home Affairs. Waiting for the power to come back on 20 minutes after loadshedding should have ended. Waiting for the post office to notify you of the parcel you ordered from Amazon 8 months ago.

Waiting is as much a part of being a South African as a Saturday braai.

But when it comes to importing your first order so that you can get your business off the ground, waiting doesn’t have to be part of the deal any longer.

“What’s in a name?” William Shakespeare may have argued that names are irrelevant in Romeo & Juliet, but when it comes to importing inventory for your business, names are very much important.

Whether you trade under your own name as a sole proprietorship or your business’s name as a registered entity, there’s no wrong or right choice when it comes to choosing a trade name. But it is a name you need to stick with for at least the duration of your incoming order. Because the name of the importer has to be the same as on the import paperwork.

But if, like Juliet, you haven’t touched on just the right name for your business, Airpool’s got you covered. We act as importer and responsible party on all our consolidated orders so that there are no customs clearance issues while you settle on your trade name.

According to South African Customs legislation, only registered importers can import goods intended for resale into SA. That means you must be a registered importer with a valid import/export licence (a.k.a. a customs code or CCN number).

With Airpool, however, you don’t have to wait for your importer clearance to start your business. We help individual sellers and small businesses without import/export licences import goods from China by acting as the importer on your transactions.

Harmonised System codes (also called HS codes or tariff codes) are standardised codes used internationally to simplify the processing of trade goods. Participating countries (of which South Africa and China are part) all use the same codes to classify different products and product categories to keep things uncomplicated.

Attached to each HS code are the compliance requirements and import taxes of each product class, making it easy for importers to confirm the compliance of their order.

To find the HS codes of your products, simply visit one of the following sites:

We live in a time where the sky can seem like the limit in terms of business possibilities. But there are a few teeny tiny limitations, one of which is the list of restricted goods:

None of the above products may form part of your import. As long as you stay with the products that form part of the extensive approved import list outside of these items, you’re good to go.

Each product also needs to meet South Africa’s labelling requirements, which are governed by the Foodstuffs, Cosmetics and Disinfectants Act and the Consumer Protection Act. So ensure you purchase items that are clearly labelled.

International freight is expensive. There’s no way around it. So it’s best to shop around for a freight forwarder whose geographical operations and internal processes will end up benefiting your budget.

As an importer (especially a first-time importer), it’s also vital to understand how responsibilities are divided in your supply chain according to Incoterms. Incoterms are a set of 11 internationally recognised rules that govern the responsibilities of international freight. They cover aspects such as who is responsible for import/export costs and who is responsible for the collection and delivery of the order.

You can learn more about Incoterms here:

International Trade Administration: Know your Incoterms

When ordering through Airpool, we take care of all Incoterms responsibilities and avoid any confusion or misunderstandings along the way.

Import tax includes general import duty as well as a number of other clearing duties that have to be paid before an import can be cleared at customs.

You can find a detailed overview of the import duties that will apply to you HERE.

Once you’re signed up with Airpool, we can help you calculate your import duties in a jiffy, saving you the hassle of going through the documentation with a fine comb by yourself. We act as your importer and clearing agent, helping you get your order without the fuss of bureaucratic red tape.

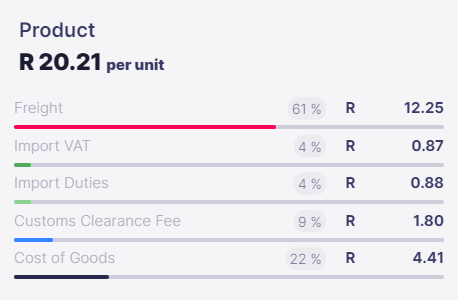

When looking for a vendor to buy from, don’t assume the cheapest quote is the cheapest. It’s the landed cost of an import that determines the true cost. This includes the cost of the goods, non-redeemable tax, import duties, and the cost of freight.

To calculate landed costs can be tricky as you require the cost estimates of all the parties who make up the supply chain to get the full scope of your costs.

Airpool’s consolidated shipping method and partnership with trusted freight forwarders makes landed cost comparison easy. Once you’re signed into your account, you can calculate exactly how much that “unbeatable” quote will actually cost you, to ensure you truly buy from the best suppliers.

Getting ready for your first import into SA shouldn’t feel like standing in line at Home Affairs. That’s why Airpool helps to ensure it never does. We simplify the process and make sure your first import is as easy as throwing a few chops and wors on the braai this Saturday.

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)