For small businesses and entrepreneurs, inventory management and a reliable supply chain are like koeksisters at a church bazaar. You simply can’t have one without the other, can you?

Unlike larger corporations and mega retailers, small businesses can rarely afford to hold the amount of inventory needed to buffer customs delays without any impact on operations.

And yet unexpected customs inspections do wreak havoc on many small business’s production timelines. All because of one or two key pieces of information that are missing from the imported parcel.

So how do you ensure your imports don’t get targeted? And how do you create a supply chain that’s resilient enough to buffer random inspections?

Customs clearance is a mandatory procedure for importing goods into any country. It involves preparing and submitting necessary documentation to facilitate the import, assess duties, and ensure compliance with local regulations. Key documents include the Bill of Lading, Commercial Invoice, HS Codes, and Packing List. These documents and key pieces of information must be accurate and complete to avoid delays.

These inspections are conducted to verify the compliance of imported goods with local laws and regulations. Inspections can range from documentary checks to physical examinations of packages and the goods they contain.

What triggers a customs inspection? A lot more than you may think.

#1 Incomplete or Inaccurate Documentation

Customs authorities scrutinize documentation closely and missing, incomplete, or inconsistent information in documents immediately raise a red flag.

#2 Misclassification of Goods

Using the wrong Harmonized System (HS) codes always smells like fraud to customs agents.

#3 Undervaluation of Goods

Lower value declarations sneakily lead to lower duties and taxes.

#4 Previous Non-Compliance

Customs authorities aren’t big on second chances.

#5 High-Risk Countries or Goods

High risk origin countries or goods are flagged as a health and safety protocol.

#6 Suspicious Packaging or Labeling

You can’t fault customs agents for flagging packages that look fishy, can you? From incorrect labels to packages that look tampered with, suspicious packages get inspected.

#7 Inconsistent Information

As part of documentation review, customs quickly pick up on discrepancies and irregularities between different documents.

#8 Prohibited or Restricted Items

When importing restricted items without the necessary license, inspections usually lead to confiscations or the return of the package to its origin location.

#9 High Declared Value

Accurately declaring high-value goods may not avoid inspections, but it will streamline the process and ensure speedy clearance.

#10 Random Selection

Finally, the luck of the draw. Random inspections do happen, even when all your documents are in order, and you need to be prepared for them.

https://www.trade.gov/country-commercial-guides/south-africa-import-requirements-and-documentation

As you may have noticed, not having the correct documents is the start of most importer’s troubles. So let’s take a quick look at the documents that incoming parcels may require:

The tricky part is knowing which of these your order requires. Working with your supplier and a local importing agent will usually help you get the right documents in order.

So how do you ensure your shipment doesn’t go through a drawn out inspection process?

When everything in your order is … well, in order, customs inspections generally take no longer than a day or two. With adequate inventory and supply chain planning, that’s a timeframe you can work with. But as soon as any irregularities are flagged, inspections can take up to two weeks, during which time the regularities are investigated.

By following these five steps, you can make sure your incoming order falls in the former group, and avoid the latter all together.

Step 1: Ensure All Documentation is Accurate and Complete

Step 2: Classify Goods Correctly with the Appropriate HS Codes

Step 3: Declare the Correct Value of Your Goods

Step 4: Use Reliable Freight Forwarders and Customs Brokers

Step 5: Stay Updated on South African Customs Regulations and Requirements

They’re simple steps. And yet they make a world of difference.

Customs inspections are as much a part of international imports as koeksisters are at church bazaars, and while they won’t ever be as enjoyable as koeksisters, there’s no reason why they should throw your production timeline on its head either.

Airpool helps you cover all the bases on every incoming package. From ensuring the right import documents are attached to each order to partnering with the most efficient customs agents, we make sure your supply isn’t held up indefinitely by simple errors.

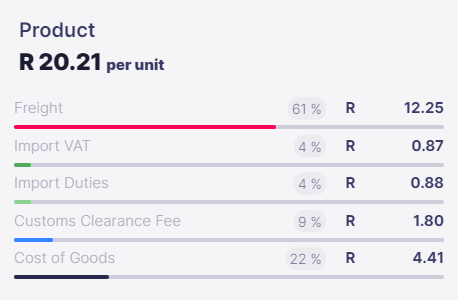

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)