When you import, a mistake can be extremely costly. And even when things proceed smoothly, hidden charges might make all the difference to your margins.

Let’s say you’re an entrepreneur who’s discovered a great product. You’ve identified a manufacturer in China who produces the items at a competitive price. You have a beautiful new online store and a killer marketing campaign ready to go. Now you just need to get the goods to your customers. How hard can it be?

If you’re growing a business and you want to keep your customers happy, the last thing you need is surprise excise costs and customs penalties. Then there’s the problem of logistics: how can you be sure you are getting the most competitive rate? That raises an urgent challenge.

Most entrepreneurs don’t really have the time to worry (and shouldn’t have to!) about the finer details of international trade. After all, when the founder is also the CEO and the accountant and the marketing director, your time is extremely valuable.

When you import, a mistake can be extremely costly. And even when things proceed smoothly, hidden charges might make all the difference to your margins. The fact is, you can make what seems like an informed business decision but in reality, without a clear understanding of the risks, it’s hard to calculate the true costs of couriering goods from China to South Africa.

To err is human (and expensive):

The hidden and unexpected costs of airfreight

If you are not fully versed in the bureaucracy of trade, it’s remarkably easy to make an expensive mistake. There are many pitfalls and often they’re set off by the smallest of errors. Some of these unexpected costs include:

VAT & Duties:

It’s not so much that Duties and VAT are hidden but often that you didn’t know they were coming. They’re difficult to estimate and that’s because the amounts are only confirmed once the packages arrive at customs in South Africa. To get those goods, you’ll have to pay those duties. To reclaim that VAT, you’re going to have to make sure you’ve cleared your goods correctly, with the documents reflecting you as the importer of record and declared the correct HS codes. In addition, excise duties (Ad Valorem) are added charges imposed on luxury items (Ad Valorem products) compounded to those of standard Duties and VAT.

Knowing the exact cost prior to shipping your goods can assist in determining the viability of the product. However, calculating the exact import VAT and customs duties on goods is complex and, for non-specialists, highly imprecise.

Demurrage:

One of the more costly errors results in what is known in the lingo of international importing as demurrage. Demurrage is a penalty charge imposed if you are liable for delays on loading goods. Demurrage is considerably higher than ordinary storage fees, and unfortunately, can result from a number of oversights such as:

– Stating the incorrect importer’s code on your waybill or not having one at all.

– Failing to furnish an NRCS LOA, confirming the goods conform to government standards.

– Incorrectly declaring goods. Obviously.

Even once your goods have successfully cleared, there’s a risk of additional expenses if you do not effectively manage the logistics. For instance, if an incorrect delivery address is provided, you could end up paying extended storage fees (while dealing with the hassle of missing your client’s delivery expectations).

Special handling fees:

A lot of couriers may charge you for special handling fees. These occur when there are special requirements for specific items along the journey. For example, non-stackable charges are a common handling fee that you don’t see coming, incorrectly placed “fragile” labels, awkwardly sized boxes, or even products that contain batteries.

Ultimately, a colossal fault exists in the courier industry in that most couriers – from the big players to brokers -are not able to show, calculate or mitigate the risks of paying these amounts upfront before the package leaves China. The result: entrepreneurs are stalled before they (and their goods) can get through the gates. literally. This is a problem we’re passionate about solving here at Airpool.

Jumping hurdles

Then there’s the problem of actually getting your goods through customs. In fact, some goods may not be allowed through the border at all. If you want to ensure your merchandise arrives on time, without extra charges or penalties, you need a comprehensive understanding of a) which goods are permitted for import and b) the special requirements involved in importing any given item.

Port Health Services may stop hazardous goods or edible items. If foodstuffs or other goods do not conform with safety standards, you lack the correct supporting documentation (such as an appropriate health certificate) the goods could be delayed or even destroyed. Packages that include potentially hazardous chemicals need to include a Material Safety Data Sheet (MSDS). This document lists important safety information, such as toxicity, reactivity and the correct way to store the item. Failing to furnish an MSDS when requested will cause your goods to be delayed. Ultimately, if you don’t provide a valid MSDS your shipment is likely to be rejected.

Similarly, importing certain classes of goods is subject to proof that those goods meet specified international standards. Failure to follow the correct procedure could see your shipment confiscated by the NRCS.

Going postal

Then there’s the question of how to actually dispatch your goods. First-time buyers who source their goods from portals like Alibaba may choose the service’s cheapest courier method. It’s often not transparent and if it’s not through a legitimate courier company (which may also be expensive) it often results in your packages landing up at a South African postal service.

For South African business operators, the postal service is hardly a viable alternative. Experience shows that relying on the postal service invariably results in delays, if the goods arrive at all. Even worse, the process is completely opaque. Once your items have been dispatched you have no way of tracking their progress. If they get caught up somewhere, there’s no service you can call and often no recourse. You effectively have to sit back and wait. That’s no way to run a business.

Collective Power: a community of entrepreneurs, working together

If you’ve ever spent time at an incubation hub or a disruption seminar, you’ll appreciate that entrepreneurs are great collaborators. The space is highly competitive. Everyone is working hard to win market share and get their best product to market. But there’s a culture of mutual respect, mentorship, and knowledge sharing.

What if we extended that ethos to airfreight? Instead of leaving every business to themselves, what if there was an easy and effective way to pool everyone’s resources?

That’s precisely the philosophy behind Airpool. It’s simple: just register on the Airpool platform and arrange for your orders to be dispatched to the Airpool hub in China. Airpool consolidates your package, so you only pay a fraction of the costs. It’s a much more affordable way to ship.

A network of specialists

But that’s not all. Airpool is a part of a network of compliance, logistics, and shipping specialists. And that means there’s an expert managing every step of the shipping process. We’re a new brand, providing a much-needed solution for entrepreneurs. But our team has extensive experience in logistics.

From logistics to VAT to customs, there’s a centralised service that ensures fast, seamless, and very simple airfreight.

And that means getting goods from China to your customers in South Africa is now affordable and hassle-free. The rest is up to you. And we know that you’ve got this!

Register on our website to transform the way you import. Or simply send an email to hello@airpool.co.za. A shipping specialist will be in touch to optimise your shipping.

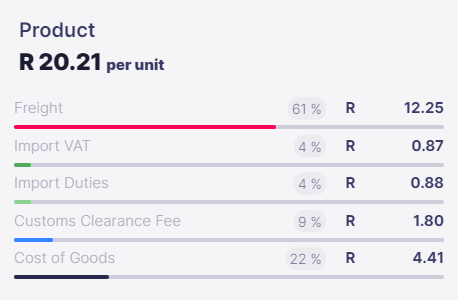

Landed cost is the sum of all expenses associated with importing your goods from China to South Africa. This includes the cost of the goods paid to your supplier, the shipping costs, clearance costs and the import taxes & duties.

It is represented on a per unit cost and helps you with:

Note: This is not what you are paying to Airpool but rather what you are paying to all the suppliers and relevant parties: Airpool, the Manufacturer of the goods and the Import Taxes (VAT & Duties)